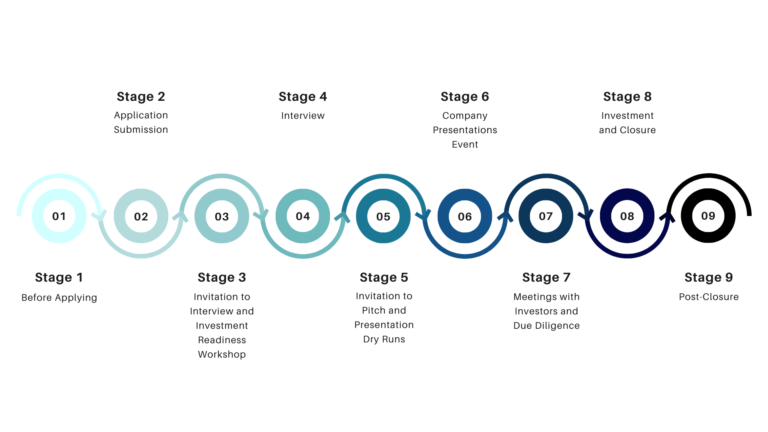

Funding process

Our 9 Step Funding Process:

Before submitting an application for consideration by Henley Business Angels, it is important that entrepreneurs consider whether funding from HBA is right for their start-up venture.

Companies thinking of applying for funding from HBA should read our Entrepreneurs section prior to submitting an application.

Once an entrepreneur has decided to apply to Henley Business Angels for funding, they will need to complete and submit our online application form.

The application form is designed to aggregate the most important information about the business, to help the HBA selection panel decide whether the entrepreneur making the application should be invited for an interview.

The information submitted on the application form is pulled through to create an Executive Summary, which is carefully reviewed by the selection panel against the investment criteria. Entrepreneurs will be contacted with the panel’s decision on the date outlined in our application timetable found below.

Applicant companies that the selection panel feel fit the Henley Business Angels investment criteria, and therefore, have the prospect of raising funds from HBA members, will be invited for an online interview.

Following acceptance of the invitation, the entrepreneur will be required to engage in preparation and practise for the presentation to HBA members.

Before the interview, companies will first attend our Investment Readiness Workshop, which features talks from HBA members, supporters and sponsors covering a range of topics. Topics covered include: what angel investors are looking for, what constitutes a great presentation, the commercial aspects of IP, and a deep insight into all legal, tax and financial details, and more, delivered by experts in their field.

Find out more about the Investment Readiness Workshop here.

The interviews for each round will take place after the Investment Readiness Workshop. Each company’s interview takes approximately one hour, and is arranged on a date and time during the ‘interview period’ allocated on the timetable.

The entrepreneur will have the opportunity to ask questions of the panel and be briefed as to what will happen after the interview, including being notified of the panel’s decision and next steps.

Entrepreneurs will only be invited to present at the Company Presentations Event if the panel agrees that there is a realistic change of securing funding from HBA.

If an entrepreneur is successful at interview, they will be invited to present at the next quarterly Company Presentations Event as one of up to five (S)EIS approved businesses.

The entrepreneur will need to accept the invitation to attend.

Henley Business Angels offers entrepreneurs one-on-one mentoring to help prepare for the Company Presentations Event, and holds a practice session for the entrepreneurs to receive feedback and advice to deliver a great investment pitch.

The company presentations will happen at the Henley Business Angels quarterly meeting.

Entrepreneurs will have 10 minutes to present, followed by 5 minutes of questions from the assembled angels. The angels will then have 5 minutes of private discussion to identify initial interest and nominate a Lead Investor.

Following all of the pitches, the entrepreneurs will have the opportunity to network with HBA members and guests at our private Showcase. This is an opportunity to demonstrate your proposition/product in greater detail, offer samples, and build further interest in the business.

Attendees of the event will then complete and submit feedback forms over the next 48 hours outlining their interest. These responses will be collected and then shared with the companies.

Following the presentations event, the entrepreneurs will arrange meetings with Henley Business Angels members and guests that expressed an interest in the company, with a view to exploring/securing funding.

If interested, HBA investors will elect a lead, if not already selected at the presentations event, conduct due diligence, and, if deemed appropriate, issue a term sheet.

Henley Business School can offer rooms for meetings between the entrepreneur and HBA investors, and HBA will continue to facilitate connections as requested.

Upon agreement of the terms, there will follow a process of drawing up a shareholder agreement and, all being agreed, a successful closure.

Typically post-closure, the Lead Angel will join the Board and provide ongoing support.

During the post-closure step, Henley Business Angels will work with the entrepreneur to develop a press release to be published on the HBA and UKBAA websites, shared on HBA’s social media, and to be released via the University’s social media and offline channels.

A success fee of 5% of the total money raised by the Henley Business Angel network will be charged to the entrepreneurs via invoice.

HBA will continue to support the entrepreneur and help with future fund raising as requested.

If you have any questions regarding the funding process, please contact the Henley Business Angels team at entrepreneurs@henleybusinessangels.com or via our website.

Do you qualify?

Read through the investment criteria to see if your business would be suitable for funding by HBA.

Henley Business Angels 2024 Application Timetable

HBA is open to receive applications throughout the year with four closing dates.

The Company Presentations events are held both face-to-face and online. The Investment Readiness Workshops are held face-to-face only and the interviews are held online only.

The dates for the current funding round are:

Applications Close: 22 April 2024

Selection of Companies to Attend Investment Readiness Workshop and Interview: 29 April 2024

Investment Readiness Workshop: 8 May 2024

Interviews: 16 May 2024 and 17 May 2024

Selection of Applicants to Present: 17 May 2024

Dry Run Presentations: 29 May 2024

Company Presentations: 6 June 2024

Applications Close: 22 July 2024

Selection of Companies to Attend Investment Readiness Workshop and Interview: 29 July 2024

Investment Readiness Workshop: 7 August 2024

Interviews: 13 August 2024 and 14 August 2024

Selection of Applicants to Present: 16 August 2024

Dry Run Presentations: 28 August 2024

Company Presentations: 5 September 2024

Applications Close: 21 October 2024

Selection of Companies to Attend Investment Readiness Workshop and Interview: 28 October 2024

Investment Readiness Workshop: 6 November 2024

Interviews: 12 November 2024 and 13 November 2024

Selection of Applicants to Present: 15 November 2024

Dry Run Presentations: 27 November 2024

Company Presentations: 5 December 2024